California finally has the opportunity to be governable after last week’s election. For too many years the ability to set policy has been obstructed by a system that allows for minority veto.

Our revenue and expenditure systems have no nexus and need an overhaul. Our education system is antiquated, our energy and environmental policies need to be accelerated, our infrastructure rebuilt and our economy reinfused.

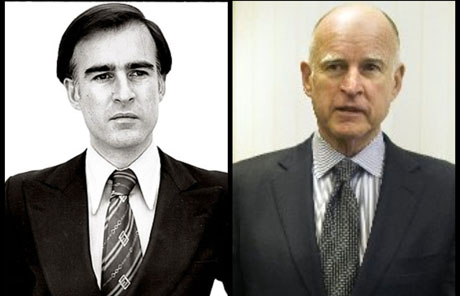

With the leadership of Gov. Jerry Brown and democratic super majorities in the legislature, the opportunity of a generation is now. Brown is the perfect governor to lead the overhaul.

He’s not a spendthrift, and this is neither a time for massive government spending nor a time to reward all of the democratic constituencies with benefits. In fact, that approach would not serve any of these constituencies in the long term. The key is to reform the governing system in California—a system that badly needs overhaul.

Brown is not timid about reform, innovation and the future. Once called Governor Moonbeam, many of the ideas Brown advanced in his first tenure proved to be omnipotent. Had California boldly gone where Brown wanted to take the state in the 70s, we would have been far ahead of the curve economically, educationally and institutionally.

But his first term was a different era. Instead of moving the state forward, a more conservative population implemented Proposition 13 by ballot initiative. The voter revolt and political success of Prop. 13 led to an all-out assault on representative government. The initiative replaced thoughtful legislation as the way for special interests to succeed in our state.

New initiatives, like Prop. 98, locked up spending. New revenue options, even small and reasonable adjustments, were non-existent because of minority obstruction. Tax revenue is tied to the boom and bust economy, and no thought is given to long-term fiscal reform. California has languished as a result.

There are those who caution against over-reaching with a new majority. That will not happen under Brown. He is nothing if not frugal. But Brown has an opportunity to fundamentally reform our broken system of government. He has the knowledge and vision to do what once seemed implausible.

From our antiquated education system, to our bloated prison population, to our failure to garnish revenue from obvious sources—California is the only state, for instance, not to tax oil production—a new paradigm must be created if California is to get out to its current negative governance. The opportunity is now.

With no obstructionists in the way, Gov. Brown can remake the governing system that has burdened California for too long. In doing so, he will be able to implement many of the ideas he had as a younger man.

The difference is the people of California are now 30 years removed from the vision of that younger governor. While they once balked at innovation, change and reform, they now embrace it. They’re ready to accept his previous vision, which they didn’t understand and rejected years ago, from renewable energy and environmental progress to education reform and fiscal responsibility.

Ironically, had we listened to the younger Jerry Brown, we would not have had to go through the pain of the last 20 years. But progress delayed is not progress denied.

Brown was 30 years ahead of his time in his first tenure as Governor. Like many visionaries, he was ridiculed for his futuristic agenda as most were unaware of the coming changes in technology, the environment and the economy. The people of California were stuck in a mindset that didn’t incorporate the vast changes occurring at the time. Now, the electorate is much more willing to accept what Brown was selling in the past.

Few political visionaries get a second bite at the apple or have the requisite circumstances to fulfill their agenda. By outliving his political rivals and remaining a political force in the long term, Gov. Brown has that opportunity. He should make the most of it.

Rich Robinson is a political consultant in Silicon Valley.

Just wondering… California has been identified as #4 in the U.S. vis a vis taxes levied on the average resident. Yet, last time I looked, our fair State was listed as #47 regarding spending per pupil in education.

I simply cannot fathom where our tax revenue goes and why it nearly completely bypasses education. Hmm, do you suppose it might be… oh gosh, I can’t say it… it’s too non PC!

First the GOV. wants to tax families who make over 250K, which is about everyone in this over taxed state, especially the bay area. Now the county adds another sales tax making us one of the highest in the country. Now the state is proposing tripling, yes 3 times our car registration. When will it end.

Then Obama care with add a 10% tax in 2013 when you sell your house.

Add there is no regulation on the gas companies when they want to raise gas prices.

Now Chuck and SJ wants to raise medical for retirees who have been retired for 20 /30+ years on a limited income. Pay 7K before your co-pays even kick in.

Then Chuck likes to use the high command staff retirements stats in their pension reform numbers, but they never mention the line officers and CITY EMPLOYEES that suffer. It is not about public safety but all city workers.

Rich, you spin numbers just like the president, county and city. That is why you get paid. You are no better that the county sup (I will put everything on my free credit card) and Chuck and his clowns.

Rob,

Spreading misinformation is wrong. There is no 10% tax on real estate transactions in the Obama Healthcare plan.

And I don’t know what Ted Lieu was thinking, but there is no way Dems are going to triple the car registration fee—and there is no way this Governor will sign it.

Here’s the scoop on the Obama tax, the misinformation has spread in an email that snopes, politifact and other sites have debunked fully.

The health care law imposes a new 3.8 percent tax on investment income, but it only applies to couples who make more than $250,000 or individuals who make more than $200,000. That investment income could include the profits from real estate transactions.

But it would only apply to those high earners, who make up less than 5 percent of all taxpayers.

The new tax marks the first time investment income will be subject to Medicare taxes, said Clint Stretch, the managing principal for tax policy at Deloitte Tax LLP, when we asked him about in 2010.

We should point out that the government currently taxes investment income in various ways and could have simply raised current rates.

But lawmakers wanted to link the new revenues to health care, Stretch said. “The point of doing it as a Medicare tax was to have the money go to the Medicare trust fund and have it act like a tax that is paying for health care. So there is additional complexity,” he said.

We’re not sure why the email extrapolates this tax to all real estate transactions, but that’s the only 3.8 percent tax we could find in the new law. We ran this by two tax policy experts who confirmed our analysis.

If you’re an empty-nester of any means, and you’re thinking of downsizing, part of your profits are already tax-free thanks to long-standing tax exemptions on the profits from home sales.

In general, if you sell your own home, individuals are not taxed on the first $250,000 of profit and married couples are not taxed on the first $500,000 of profit. Again, that’s profit, not the sales price.

If you’re wealthy and sell your home at a substantial profit, it’s possible you might get hit with the new 3.8 percent tax on investment income. Most Americans won’t have to worry about this, though.

The chain email doesn’t acknowledge any of those pesky facts. It says that a 3.8 percent tax applies to all real estate transactions as a sales tax. That is not the case. The email seems intended to scare people, particularly older Americans thinking of downsizing. For that, we award this chain email a Pants on Fire!

Rich,

you try to explain away 3.8 percent like it is no big deal. It is, and did noy even bother to comment on most of the other taxes coming our way.

And you forgot about the 28 million taxpayers — about one in five, all middle to upper-income — will have to pay the alternative minimum tax in 2012, raising their taxes more. That is because Congress has failed to pass an inflation adjustment to restrict the number of taxpayers subject to the AMT largely to the affluent.

Also under Obama the emergency unemployment- compensation program is expiring, which would save $26 billion but end payments to millions of Americans who remain jobless and have exhausted state benefits.

And then Medicare payments to physicians would be reduced 27 percent, or $11 billion, because Congress this year has not passed the usual fix to block the cuts. The biggest cut would be $65 billion, enacted across the board for most federal programs over the last nine months of fiscal year 2013, from January through September.

This cut, known as the sequester, was mandated by an August 2011 budget deal between Obama and Congress

The 3.8% is no big deal to those who will pay it. Given the amount that the uber-rich spent trying to elect Romney, the amount they pay their accountants to avoid taxes, the number of corresponding deductions they get that average Americans do not. It is no big deal, not a problem—will impact no one severely.

You can expect the AMT to be fixed before Jan 1 now that the election is over, same with “the sequester” or “fiscal cliff”. Elections have a tendency to move the needle. Where nothing has been done before the event; it serves no politician to be an obstacle in this new political environment. Even McConnell is making noise for compromise—no surprise he is up in two years.

We do have challenges. It will never be perfect, but let us not make the perfect the enemy of the good. Keep working and we can get some things accomplished.

I’ve never been more hopeful that big problems will be solved. I could be wrong—but Americans are going back to work and we have decided, as a nation, the direction we want to head.

It is the nature of a democratic republic.

Rich,

You are really starting to sound like PO and are so bias in your comments.

“No big deal?” A 25% increase in capital gains tax, nearly that in state income tax (which applies to capital gains) is no big deal? Add to that the increased costs driven by cap & tax. Not to mention more sales taxes.

This is a big dal. Next year, politicians will be scratching their heads wondering where all the increased tax revenue they were expecting disappeared to.

We are truly screwed.

Thank you Jeeper. Rich seems to think it is no big deal and must think we are all “super rich”. It is the medium income workers and retirees that will be screwed the most.

The thought of a Democrat super majority conjures up the image of a bunch of ugly buzzards squabbling over the carcass of our once great state.

We have 1,037 school districts; 1 district LA Unified has over 1/3 of the students in CA.

That means the other 1,036 districts oversee 2/3 of the student population. We only have 58 counties.

The method for education evolved from the 19th century. 21st century technology has made much of the curriculum irrelevant. Our teachers are overworked and underpaid. Administrators are overpaid and don’t work as hard.

We need a new system; reform is not enough. We need an entirely new educational system worthy of the new 21st century economy.

Teachers are overworked and underpaid relative to what? The school year has gotten shorter. School days are shorter. How horrible it must have been under Moonbeam Part I!

Rather than lamenting the need for a “worthy” education system, how about proposing one, and working to get it implemented?

Even with a super majority, this state will prove ungovernable. The constitution is over 100 pages long. We need to throw it out and start over again (btw, the U.S. constitution is like 12 pages).

Agree on Constitution.

I do have a proposal for an entirely new system, too complicated to post on a reply—may blog about it in future.

Thanks,

RR