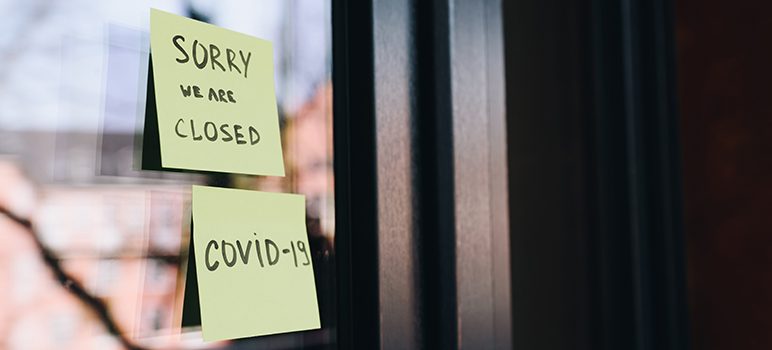

San Jose Mayor Sam Liccardo joined community partners and small business owners this week to highlight resources available to small businesses and remind owners to submit Covid-19-related insurance claims by March 16 to get some money back.

During the virtual conference Thursday, Liccardo and Paul Caputo, a trial attorney from Caputo & Van Der Walde LLP, underscored the importance of small businesses filing insurance claims. “Some business owners don't realize that if they simply carry a run-of-the-mill business insurance ... many if not all of those policies also have what is known as business interruption coverage,” Caputo said.

Under that business interruption coverage, small business can make claims for income loss as a result of business being interrupted because of direct physical damage to or loss of their property. “In other words, a governmental agency, because of these stay in place orders and so forth denied access to your property,” Caputo said. “And the governor’s March 16 edict constitutes a direct physical loss of or damage to your property.”

That legal argument is contested by some insurance agencies and lawsuits have been making their way into California superior courts.

Caputo said he expects this matter to reach to the state's supreme court and anticipates the state to side with small business owners—who he called “the good guys.”

He said he is uncertain when this topic will see its day in the state supreme court, however.

But for those interested in making a claim, the deadline is coming up in about a month.

Caputo said claims should include a letter that includes the insured’s name, policy number and explanation about the need to recover lost income because of a business interruption and civil authority, “i.e., the governor’s closure orders.”

He also suggested that owners to request a copy of their current coverage. However, there is no guarantee that claims will be fulfilled by insurance agencies.

Johanne Desjardins, owner of Pure Bliss Float Center and Spa, said she filed all the claims she could and was denied. She said her insurance told her a virus is not covered.

She said the business closures and subsequent loss of income forced her to sell her car and her house. For about a month she has been “couch surfing” in an effort to save her businesses, all while battling breast cancer.

“Since Jan. 15 ... to try to maintain my business, I sleep in my business,” Desjardins said. “Now that we are reopened, I am there to try to catch every phone calls and emails and trying to reinvent myself.”

The 59-year-old business owner said Covid-19 turned her world upside down. She had invested most of her money into her spas and planned to sell them in a few years to secure her retirement. Now, she said, she doesn’t know if it’s a possibility.

“I am so low right now,” she said. “My business is down. I cannot go lower than where I’m at, so it's time to go up.”

Desjardins is one of thousands of businesses in Santa Clara County struggling to hold on.

In fact, 2,600 Santa Clara County eateries have temporarily closed while more than 1,000 have shuttered permanently, according to Scott Knies, executive director of the San Jose Downtown Association.

Liccardo discussed several state and local resources available to small businesses including the PPP Playbook, the Shop Local Digital Directory Resource which helps buyers find and support local businesses and Al Fresco—a city program that allows restaurants and other businesses to apply for free use of private parking lots, public sidewalks, parks, plazas, and other outdoor amenities to continue operating outside.

All resources can be found at siliconvalleystrong.org.

I am certain that the commercial real estate market will be helped by not being able to collect rent or recover possession of their property. NOT!