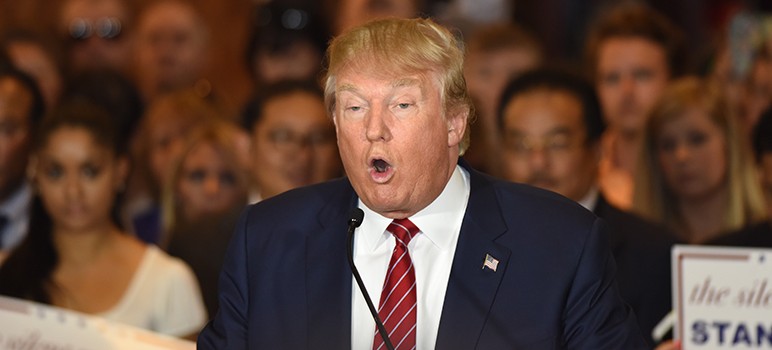

Tax day came and went, and in a shocker to absolutely no one President Donald Trump missed yet another unofficial deadline to publicly release his tax returns.

Aside from two relatively minuscule leaks, we still have no idea how the president of the United States and weekend lord of Mar-a-Lago makes his money, how much he pays in taxes, if he receives any gifts that could be considered a conflict of interest, or how much he’s given to charity.

We can quantify how much it costs American taxpayers to pay for Trump’s weekly South Florida golf trips—$25 million to date, according to the aptly titled website IsTrumpAtMarALago.org—but we have no idea how much he has personally benefited from the golf courses he owns. Without any of this knowledge, the American public is incapable of knowing whose interest Trump has put first in in his first 100 days.

“I think the main concern is that he’s breaking a tradition that’s gone on for a few decades,” says tax attorney Annette Nellen, a San Jose State University professor of 27 years. “I think it helps the public just to show that, yes, they’re regular taxpayers, they comply with the law.”

While there is no law requiring Trump to release his returns, the situation is especially galling when noting that every elected official in the state, or, say, a city like San Jose, has an annual requirement to report all outside sources of income to the state’s Fair Political Practices Commission in what’s called a Form 700. It requires the disclosure of stock investments, real estate holdings, outside income, gifts and payments received to cover travel.

The same form is required for every staffer on the 18th floor of City Hall, meaning a low-level policy aide in San Jose, such as Laura Nguyen, who was hired in February to join the staff of Councilman Sergio Jimenez, has greater requirements for economic transparency than the president of the United States.

“That's a good point and some of the things we’ve heard is some members of this cabinet have stricter conflicts of interest than the president does. That’s surprising,” Nellen says. “I’m not sure that is going to be a law that gets changed under this president.”

Nguyen graduated from San Diego State University in 2015 and had a two-year stint with a television station in San Diego, according to her LinkedIn profile. Two weeks after joining Councilman Jimenez’ team on Feb. 14, she filed a Form 700. She reported no reportable interest regarding income or gifts, but that’s not the point. The form is an official state document signed under the penalty of perjury.

Would the disclosure of tax returns solve all of the mysteries surrounding Trump’s shady business dealings? Well, no.

“Every time we’ve seen someone release their returns, we have no idea if they are under audit, or if that is their final return,” Nellen says. “So, we do take a lot at face value.”

But the president’s position that he’ll release his returns after the IRS finishes an audit of his forms—an that audit has still not even been confirmed—is erroneous.

“The audit really has nothing to do with [releasing the forms],” Nellen says.

She also notes that any hopes for a Russian bombshell should also be tempered. “Sometimes you hear we’d find out about his Russian connection. If he has a partnership it will not show every invoice paid. Some of those things we would not know from his return.”

That would still be better than the status quo.

Josh Koehler, Please publish your tax returns to show us that you have high ethical standards. I want to know that the people I read are regular taxpayers, that they comply with the law.

The day I get the nuclear codes I will gladly provide them.

Had Barack Obama’s background been investigated for a position as a police officer, by law he would’ve had to produce his birth certificate (no three year wait allowed) and his college transcripts. He would’ve been polygraphed, psychologically tested, and compelled to account for his every place of residence.

In other words, the secretive Mr. Obama would never have qualified for hire, even if he produced his tax returns, because there is no law requiring that, just as there is no law demanding it of President Trump.

> every elected official in the state, or, say, a city like San Jose, has an annual requirement to report all outside sources of income to the state’s Fair Political Practices Commission in what’s called a Form 700. It requires the disclosure of stock investments, real estate holdings, outside income, gifts and payments received to cover travel.

You mean you KNEW this information was available for Sam Liccardo, Barbara Boxer, Dianne Feinstein, and Jerry Brown and YOU DIDN’T PUBLISH IT?!!!! WHY NOT????!!!!!!

Jerry Brown is, reportedly, a TRIPLE DIPPER! Dianne Feinstein reportedly had HUGE conflicts of interest while serving on the Senate’s Milcon Committee. Barbara Boxer’s middle name is — or ought to be — “house banking scandal”. And Sam Liccardo? He can’t seem to remember what’s in the U.S. Constitution. Can he remember to pay his bills or report illegal aliens to ICE or report campaign contributions from human traffickers in illegal aliens?

Tax returns of individuals are protected from disclosure by federal and California law. Don’t like it? Change the law. A Form 700 is stated in general categories with very wide monetary levels of disclosure, and requests no specifics regarding to whom you might owe money, or which particular stocks you own. The comparison to a tax return is inapt. A tax return tells very little, if anything, about potential conflicts of interest. This entire tax return controversy is a red herring. Obama may have provided his tax returns, but he spent millions to keep his college transcripts secret. Why would anyone with good grades want to keep them secret? Or maybe the transcripts just don’t exist any longer. He was not able to keep secret the fact that he attended one college on a scholarship limited to foreign students. All this drivel on both sides has kept the federal government from passing much significant legislation for a decade now. Oh wait, that’s probably a good thing.

> He was not able to keep secret the fact that he attended one college on a scholarship limited to foreign students.

Very interesting.

I never read this in the New York Times, the Mercury News, San Jose Inside, or heard about it on CNN or MSNBC.

Isn’t a scholarship something to be proud or? Why would they keep this a secret?

Assuming the “they” you refer to is the mainstream media, if you can’t figure it out, well..

as far as the form 700

no specifics regarding to whom you might owe money – WRONG

, or which particular stocks you own – WRONG

that is the whole point of the form 700 you have to list ALL of that out in detail

Obama was a foreigner here on a scholarship limited to foreigners? So when did he become an American citizen? If he was an American citizen how did he get a foreign scholarship? Who paid for that scholarship and why?

Have the Russians given up Hillarys 35000 deleted Emails? Have the Clintoons revealed how much the Russians contributor to the Clintoon Global initiative for obtaining 25% of the US’s strategic reserve of uranium?

Seems to me an investigative reporter of your caliber Josh might at least crack the door open to these enquiring questions.

By the way I’m positive the “Obama Deep State Operatives” inside the IRS will reveal any Trump indiscretions if they can find any.

> By the way I’m positive the “Obama Deep State Operatives” inside the IRS will reveal any Trump indiscretions if they can find any.

Josh:

Remain calm. The Trump Tax Returns crisis will resolve itself. Mr. Gun is undoubtedly correct.

I’m sure that Susan Rice, Lois Lerner, MoveOn.org and the Daily Kos are going through Trump’s tax returns at this moment, and if ANYTHING untoward is discovered, the red phone on your desk will ring, the light will flash, and the klaxon on your fax machine will sound off.

Of all the possible items affecting San Jose residents, I’m baffled why Trump’s tax return merits any attention by SJI.

Taxpayer,

If you consider some of the symptoms common to late stage dementia — delusions, paranoid fixations, aggressive outbursts, etc., and accept that progressives are experiencing a similar loss of control over their world, it will help you recognize brain dysfunction as the source of the otherwise incomprehensible behavior of Trump-haters.

As difficult as it might be to accept, most of these disabled souls deserve our sympathy as they did not come into this world asking to be raised by incompetent parents, brainwashed by academia, duped by the liberal press. Imagine if you or a loved one had been so manipulated by nefarious forces that you grew up admiring the decadent and deceitful Ted Kennedy, seeing culture as an evil, equating borders with race hatred, and ashamed of your nation’s history?

Donald Trump is to the hysterical Left what J. Edgar Hoover was to several generations of paranoid schizophrenics. They see him everywhere, blame him for everything, and use him to keep accountability at bay.

I have heard from a very reliable source that the Trump tax records are being kept in a very secure vault, under Obama’s real birth certificate, which is under his college transcripts, which is under Michelle’s college thesis, which is under Obama’s foreign student passport and Hilary Clinton’s private email server and the 33,000 deleted emails.

People protesting want transparency. Then Iet’s start publishing the names of all the welfare recipients. American taxpayers deserve to know where their tax money is going.

> I have heard from a very reliable source that the Trump tax records are being kept in a very secure vault, . . .

I heard that Ann Coulter was going to disclose the location of the very secure vault during her speech at U.C. Berkeley.

LOL, you guy’s are great Americans!

It is the absolute duty of all real, true Americans to pay as little in taxes as they can and keep as much of their own money away from the government as possible. I don’t care if Trump ever shows his tax returns! I hope he got a refund! If I paid more in taxes last year than some billionaire, that’s not their fault, it’s my own fault for not being able to figure out a way to hide more of it and ultimately it is the fault of all the politicos that passed the confiscatory tax laws that took my money in the first place. Trump didn’t take my money, the IRS did!

Just remember Josh. It’s behavior like THAT (your petulant failure to publish my comments) that resulted in Donald Trump being elected President. Own it, leftie.