To understand what happened with the state budget in 2024, you have to go back to 2023.

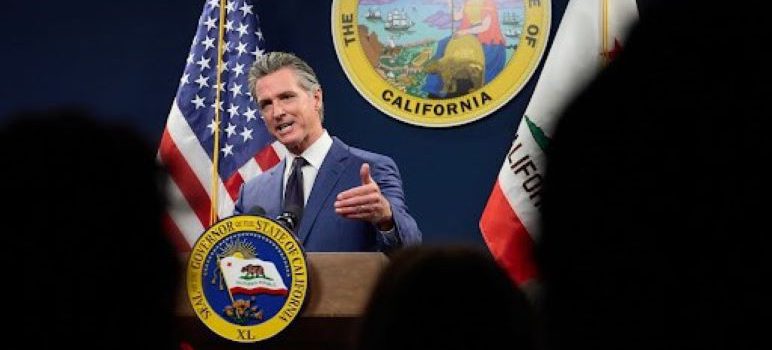

That year Gov. Gavin Newsom and Democrats who control the Legislature decided against raiding the state’s roughly $37 billion rainy-day fund despite a shaky fiscal picture. Those dollars came in handy as lawmakers grappled to plug an estimated $56 billion shortfall this year and next.

That the state had a major deficit is partly the fault of flying fiscally blind. In response to devastating storms, federal and state tax collectors extended filing deadlines last year well past the date lawmakers normally finalize the state budget. As a result, the revenue picture was incomplete. Basically, the state spending plan last year assumed more revenue than what ultimately flowed in, all because key data wasn’t available in time.

What are these deficit numbers in context? The state’s general fund budget — spending on schools, health care, prisons, green energy initiatives and more — from July 1 to next June is $298 billion, among the highest ever.. As recently as 2021, the state was spending $270 billion.

How’d lawmakers close this year’s budget chasm? For starters, they pulled $12 billion from the state’s reserves for the next two years. Lawmakers also cut most state agency allocations by almost 8%, eliminated thousands of vacant government jobs and got rid of a handful mid-sized spending programs — savings of $16 billion. Gone was a plan to have the state lend colleges money to build more student housing, $1.1 billion in affordable housing and about $500 million for a new program that would have paid college students to work in jobs tied to their majors.

Other savings came from freezing business tax credits. Then there’s the budget “fund shifts” lawmakers apply to the numbers that move money around to notch savings.

Among the few state programs that actually saw their budget grow? Public colleges and universities, though the University of California and California State University are slated to see those 8% cuts next year, unless the state budget picture improves.

The 2025 outlook

Revenues so far are higher than what was anticipated — thanks to big gains in the stock market, particularly in tech, and the income tax those investors pay. But the Legislature’s independent budget analysts say all that extra revenue doesn’t mean there’s room to spend more, in part because they’re projecting multi-billion dollar deficits through 2028-29. Plus, so much of what California spends money on now is expected to get more expensive.

Ultimately how much the state decides to spend on its vast array of programs — we’re not the fifth largest GDP in the world for nothing — depends considerably on the stock market and the incomes of California’s richest residents. Capital gains taxes from a hot Wall Street means big bucks for the state’s programs.

A Republican-led White House and Congress with an eye toward tax cuts might spur stocks to soar (though tax cuts often mean federal program cuts). But President-elect Donald Trump’s plan for heavy tariffs and mass deportations of undocumented workers could crimp the economy because of higher inflation and worker shortages.

Mikhail Zinshteyn is a reporter with CalMatters.

By taking our money, our future, our prosperity, that’s how California always pays for everything.

I’m concerned about the cuts to higher education, especially with the long-term plans for UC and CSU. Public universities should be prioritized for funding. Higher education is key to California’s future workforce, and reductions like this could hinder students from getting the quality education they need.