A Silicon Valley lawmaker wants to tax corporations that pay workers so little that they rely on public subsidies to scrape by. The Corporate Responsibility and Taxpayer Act, introduced by Rep. Ro Khanna, would make large companies foot the bill for the cost of food stamps and housing vouchers their employees need to make ends meet.

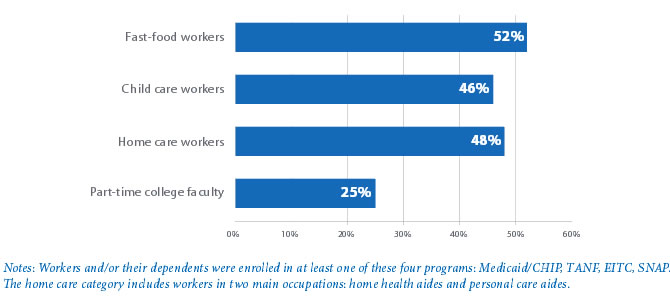

The congressman cites a 2015 study by the University of California, Berkeley, Labor Center, which calculated the high cost of low wages. Researchers found that low-wage workers in the U.S. cost the taxpayers about $153 billion a year in government assistance.

Fast-food wages alone come with a $7 billion side of public subsidies. By paying the legal minimum and keeping people on part-time schedules, McDonald’s and its ilk force workers to rely on public programs such as food stamps and rent subsidies.

In Silicon Valley, one of the most expensive places in the nation to live, the minimum wage is higher and on track to reach $15 an hour in a few years. But the cost of living is so high that even six-figure salary earners struggle to get by. Low-wage workers simply cannot afford to live independently or afford a family in Santa Clara County.

In Silicon Valley, one of the most expensive places in the nation to live, the minimum wage is higher and on track to reach $15 an hour in a few years. But the cost of living is so high that even six-figure salary earners struggle to get by. Low-wage workers simply cannot afford to live independently or afford a family in Santa Clara County.

People who bag groceries for a living should not have to rely on food stamps to feed their families, Khanna said. And taxpayers should not have to subsidize them so wealthy corporations can turn a bigger profit, he added.

“Companies are short-changing their employees by not paying a living wage,” Khanna said in announcing the legislation earlier this week. “These companies are creating a drain on the economy by underpaying workers and should be responsible for covering the cost of the programs their employees rely on to make ends meet. It is my hope that this bill will further incentivize these companies to pay their employees a living wage without cutting their hours.”

The proposed tax would only apply to companies that employ more than 500 people. It would require those companies to pay the entire cost of medical, housing and food subsidies their employees are qualified to receive.

In California, 6.8 million working families—defined in the UC Berkeley study as a household in which at least one person works—rely on Medicaid. More than 2.3 million qualify for the Earned Income Tax Credit, a tax benefit for low-income workers. And nearly a million rely on food stamps.

"Every American should have the basics: affordable housing and a livable wage,” said Rep. Barbara Lee, a cosponsor of the bill. “It is unconscionable that CEOs siphon off billions to line their own pockets while their employees struggle to make ends meet.”

To read the bill, click here.

Unfortunately, Khanna is spewing the typical leftist communist ideology that is still the mantra of the Democratic Party. Here, once again, is another variation of an entitlement to live in the Bay Area. Tax corporations to pay for your less than worthless ability to support yourself without the other “guy or gal” footing the bill to have you in their midst. What’s next, “A chicken in every pot?”

Go pound your communist based salt somewhere else Congressman Khanna.

David S. Wall

Dude you are an asshole! David, did you even read the bill?? You cheap ass mofo!

Under Khanna-lism, America’s corporations will be divided into two groups: those taxed for public subsidies and those exempt, the distinction based on two arbitrary factors (the number of employees and the government expenditures to be recovered).

These factors, when examined for their combined impact, appear aimed at corporations that, besides disproportionally employing lots of marginally-skilled workers, have only a marginally-supportive relationship with the Democratic Party (agribusiness, retail, fast food). Mr. Khanna would, no doubt, describe that as an unintentional consequence of a fair and just law.

But what if the government expenditures targeted for recovery were changed from public subsidies to infrastructure and transportation costs, and every large corporation was taxed to pay the road and rail expenditures accumulated by every employee who commutes to work? Would Mr. Khanna see that tax, which would knock the snot out of Dem-darlings like Google, Facebook, etc., as also qualifying as an unintentional consequence of a fair and just law?

If restocking the national treasury is the true aim of this tax scheme, how can it make more sense to burden employers for costs the government incurs due its generosity (and desire to create dependents) than for costs instrumental to productivity? After all, reining in the cost of public subsidies requires only ink and determination, while America’s road and rail problems will only be solved with money — big, big money.

It has been estimated that every dollar INVESTED in infrastructure repair could add 20 cents to the Gross Domestic Product, the traditional impact of a rising GDP being increased employment opportunities. Yet here we have a young congressman peddling a very old and tired agenda, one likely to reward tens of thousands of low-wage workers with pink slips, all for the sake of his political party.

Give Congress this power and with it you give them the power to lower the tax bar from 500 to 100 or even 10 employees, plus the power to seek reimbursement for unpaid student loans or anything else that strikes their fancy.

Ro Khanna’s proposed Bill would force fast food customers to hand over more of their own after tax money to the burger flippers who lack the gumption to go out and learn a skilled trade, or to get an education in something that employers will pay more for. Instead, Khanna proposes to subsidize their laziness.

And apparently Khanna won’t represent the fast food customers, only the burger flippers. How is that fair? It looks like the burger flippers are Khanna’s constituents, but not the fast food customers that he wants to arbitrarily tax.

Here’s an idea: Khanna’s burger flippers could go to night school in their spare time, and get a degree in something that pays a ‘living wage’. That way the customers wouldn’t be forced to subsidize the burger flippers, and ex-burger flippers would have a skill that pays well. Win-Win!

But, NO-O-O-O-O! That’s not the Democrat way.

Instead, this newbie politician wants to use the State’s police power to force everyone who wants a fast, inexpensive meal to transfer more of their own after-tax money into the pockets of unskilled folks who aren’t doing what’s necessary to get a better paying job.

If Khanna’s Bill passes, burger flippers wouldn’t have to do anything to collect free money. They would be subsidized for not doing anything to improve themselves. Instead, Khanna proposes to reward laziness at the expense of other folks, who haven’t done anything to keep burger flippers in their current jobs.

Khanna is grandstanding. His Bill would transfer money from one group to another. For nothing. At an innocent party’s expense. And with no incentive for the recipient to improve themselves. In fact, it would create a new incentive to keep people flipping burgers for even longer.

That’s the Democrat way—and it’s a major reason that our state is in such terrible shape. Our former “Can Do” attitude has morphed into “Can’t do” whining—which is now being done on behalf of the “victims” by an elected sniveler! What, burger flippers don’t have what it takes to organize their own burger-flippers union? Maybe not. But why does it follow that Big Government must step in and make everything better?

And like a tick on a dog the bureaucracy would balloon, since we would ‘need’ more drones to administer Khanna’s added laws and regulations… Have we really sunk this low, folks?

Khanna says burger flippers need more money because they exist. Or something. Oh, and because the private sector is “unfair”. As a remedy, Khanna proposes to have the State hold a gun to the heads of one group, forcing them to hand over their money to burger flippers. But has anyone seen fast food joints holding a gun on people, and forcing them to flip burgers? Me, neither.

We’re in debt up to our ears, with fewer and fewer producers, and saddled with a Legislature and Governor that can shove anything they want down taxpayers’ throats—even to the extent of forcing fast food patrons to pay higher prices for food, because burger flippers won’t learn a trade that pays better.

Khanna claims that burger flippers are “victims”, so he proposes to fix that by confiscating money from other folks who are also trying to make ends meet. He deliberately ignores the fact that his pandering to one group robs others. (Ro could learn something worthwhile by reading Bastiat’s Broken Window Fallacy, such as the difference between that which is ‘seen’ [burger flippers], and that which is ‘unseen’ [customers.] But Ro won’t read Bastiat, will he? His head might explode from the cognitive dissonance.)

It’s depressing to see Khanna, who tried so hard to get elected, quickly morphing into another pandering politician who thinks it’s A-OK to take money from Joe, and hand it to Schmoe—without Schmoe having to lift a finger for it.

We’d be a lot better off with Mike Honda still snoozing through this term, instead of having to watch this blatant pandering—and right at the beginning of Khanna’s very first term.

What’s next, Ro? Forcing teachers to subsidize their students?

Hmmm-mm. Now there’s a thought…

What Congressman Khanna wants on policy matters just about as much as what someone in the comment threads on San Jose Inside wants: both have an equal amount of influence on legislative outcomes.

The law is another effective minimum wage boost. Like the minimum wage, this will encourage employers to use automation and offshoring to eliminate low-skill labor or move it to other jurisdictions. The burden of this will fall on the least-skilled people, those trying to get a leg up on the employment ladder. Teenagers will have no job options. Mom-and-pop restaurants will close. Fast-food restaurants will move to tablet ordering and robot chefs. Retailers will go to self-checkout. The shift to self-driving vehicles will accelerate. Watch for a union exemption, so the few remaining low-skill workers will have to pay union bosses to get a job.

> this will encourage employers to use automation and offshoring to eliminate low-skill labor. . . .

And once the progressive aristocrats eliminate ALL low-skilled labor in the area, they will RAISE the minimum wage for burger flippers and janitors to $3,500 per hour — AND FEEL REALLY, REALLY GOOD ABOUT THEMSELVES.

How will the progressive aristocrats eat, you ask? They will use Lyft’s new courier service to have their Big Macs brought in from Tracy or Salinas.

Perfect example of a proposal that will sound good to the average ignoramus but is totally and completely bogus. Funds would be much better spent on ways to make it easier for low-skilled job seekers to comparison shop for wages.

Companies pay employee’s based on two factors what will people for in the area and how much will that add to the cost of the product they are producing at the point of sale to return X amount of profit which is why a company is in business. They must be competitive with others or MOVE to a place where they can produce at a competitive price! Forcing them to increase a wage artificially also puts pressure on that some company to pack up and move if the cost burden out weighs the profit margin, the reason they went into business in the first place. Keep in mind the college in California which pushed for $15 an hour minimum wages once the State enacted them laid off around 300 employees because they could no longer afford to keep them on the payroll! The teaching staff thought an increase was a good idea but never consulted book keeping to see if it worked for them! Theory and reality some times clash badly, this is because theory leaves out the messy details of reality and people who are very real and don’t know they are suppose to act according to the theories as written down.

The end result will be companies which used to hire people at low wages, because these people were not very productive, will stop hiring, and more people will end up on welfare.