California is awash in cash — $100 billion says Gov. Gavin Newsom.

While much of the federal aid and taxes from the rich will be used to provide core services such as education and health care, the windfall also provides a once-in-a-generational opportunity to tackle one of California’s most vexing problems: income inequality.

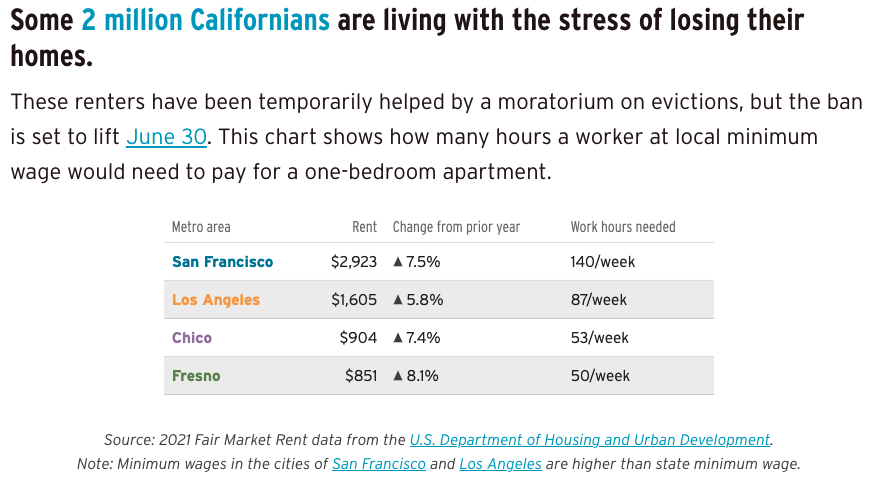

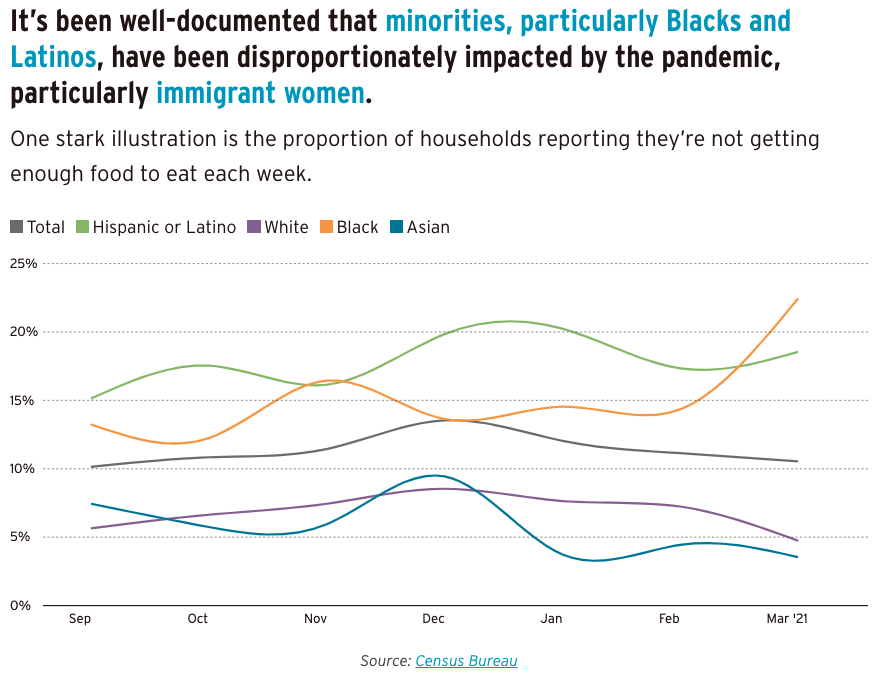

As the pandemic exacerbates a pre-existing wealth gap that has disproportionately hurt women and people of color, the California Divide’s five-newsroom team has found renters bracing for an eviction tsunami, residents saddled by water bills, parents put in lifelong debt by child support, and students unable to access stable broadband for learning.

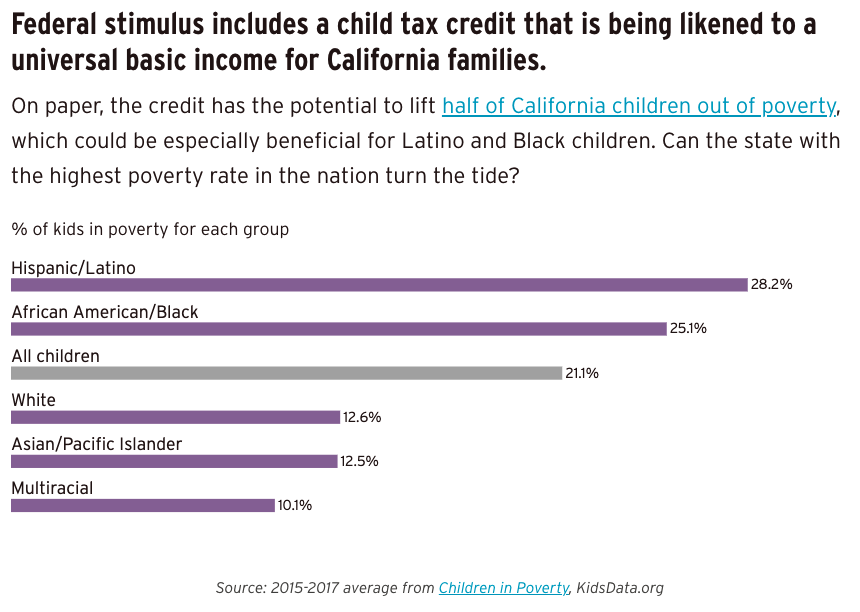

Expectations are high for a turnaround. Already, experts have speculated that the federal relief alone could be enough to cut California’s child poverty in half.

Our dashboard is intended to be a gauge for California’s response.

As the governor and Legislature debate spending priorities, our team is interested in monitoring the effects on the ground: How is the state using its surplus to improve lives? Are low-income workers making gains relative to those at the top? Can tenants afford rent in the region they live? Is child poverty going down?

Through these questions, we hope to monitor whether the state is on track for a more equitable economic recovery.

How much federal stimulus money are we getting?

A significant portion of federal aid is going directly into people’s pockets in the form of stimulus checks, unemployment benefits and emergency rent relief.

But state and local governments will benefit by the billions to help close deficits, boost education spending and increase public assistance programs.

Click each rectangle to see more detail.

How much are we spending on the state’s budget?

In the case of the state, Newsom and lawmakers also have a surplus to spend.

In his latest budget proposal, the Democratic governor charted a course to expand preschool, summer school and after-school programs. He also wants to expand the Golden State Stimulus to the middle class, among a long list of ideas.

Hover over each rectangle to see more detail.

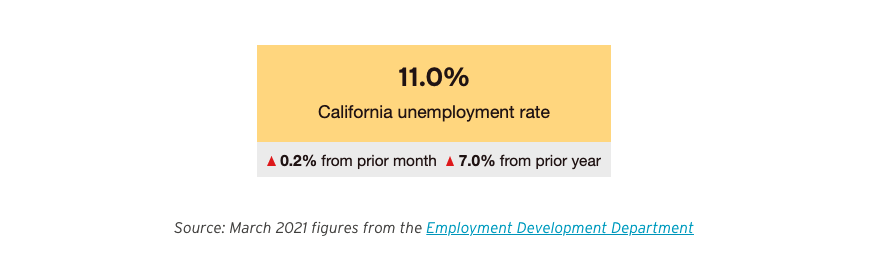

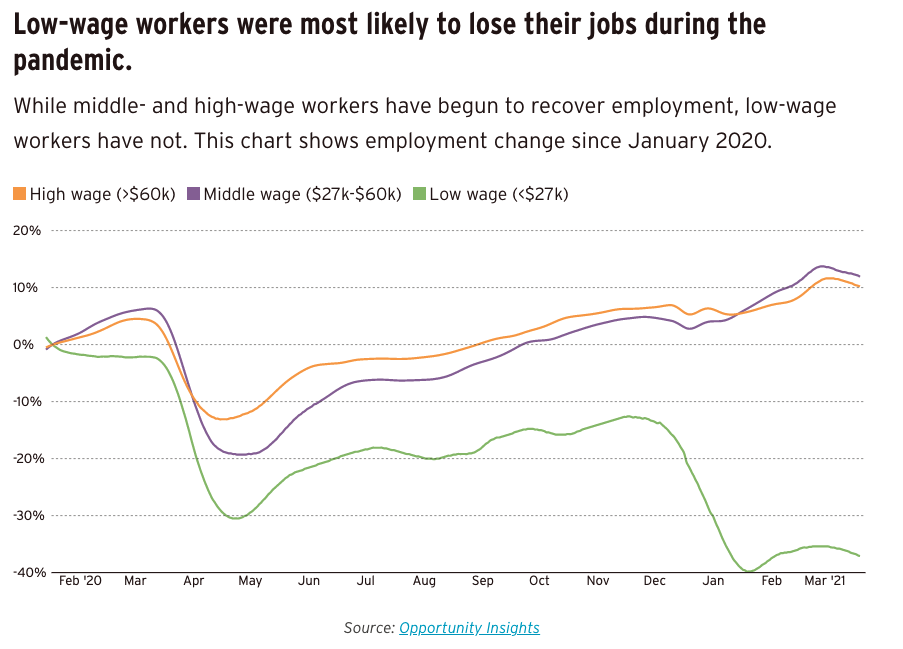

Who’s able to find work?

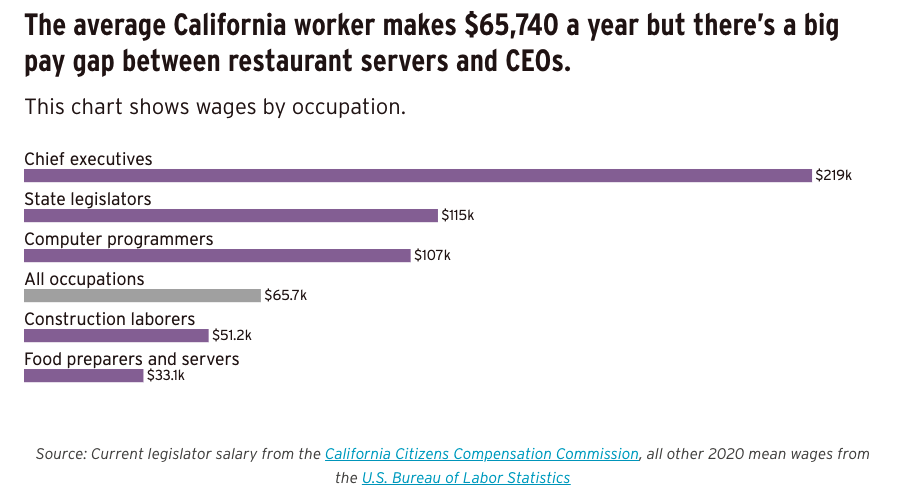

And what’s the pay gap?

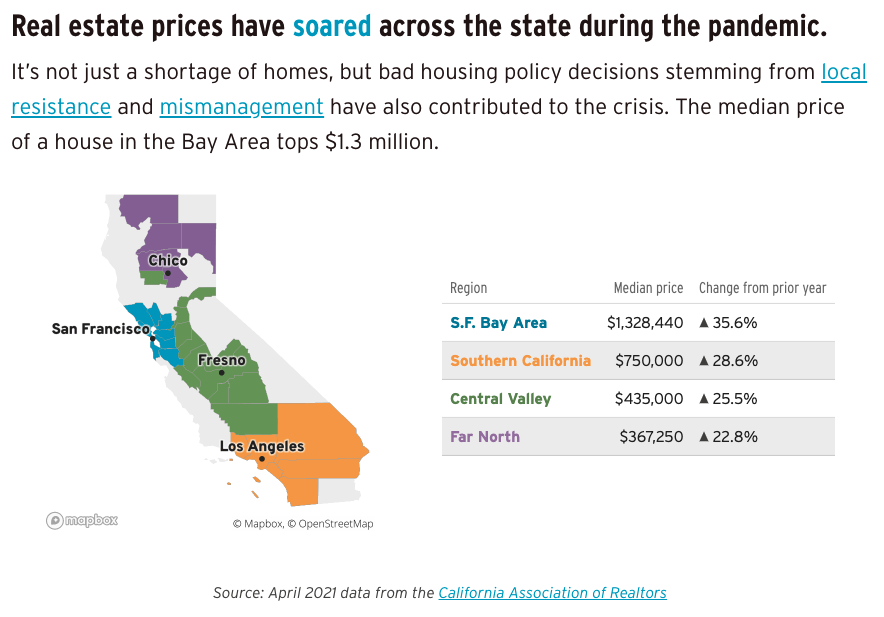

How much does a house cost?

And can tenants afford rent?

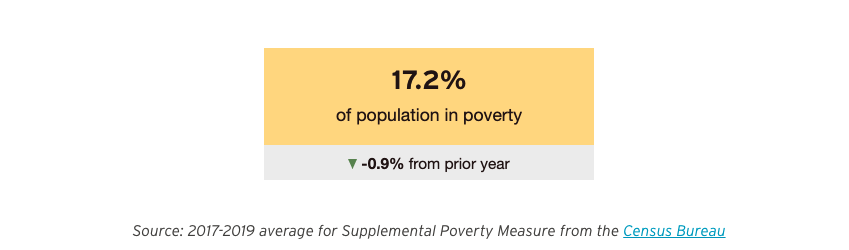

What’s the poverty rate?

And how many people are going hungry?

CalMatters staff Judy Lin, John Osborn D’Agostino, Jackie Botts and Nigel Duara contributed to this story.

This article is part of the California Divide, a collaboration among newsrooms examining income inequality and economic survival in California.

The federal money is one-time and short-term windfall assistance, and nobody sane expects a windfall or considers themselves entitled to it. Liberals here (and elsewhere) have a child’s relationship to the federal government, whom they view at their parent all too often (as well as Santa Claus, fairy godmother — is that sexist or otherwise offensive? — or a just a magic genie or other source of money). This is temporary assistance, hardly something to expect or, also wrong, view as permanent. So, don’t do it. (Grow up, too.)

Keeping schools and businesses open would go a long way toward increasing everyone’s income. Unfortunately, we’ve been ordered to do the opposite.

Giving people a basic income is not going to fix this. Any basic income program should instead put any money they would give a family (i.e. federal benefits) into a fund for higher education and job training. Then, you’re talking about lifting people out of poverty, especially the kids, for the long term. Poverty isn’t solved by unsustainable programs – a family solves it by setting goals and enrolling in training and education which the government can help facilitate. Huge entitlement programs which many individuals in poverty are in (i.e. Section 8) have proved to NOT help households out of poverty, it simply creates cycles of poverty through multiple generations.

long term welfare also has the side effect of making the rich far richer

while the middle class services the debt

better to live in a middle class world in which most can take care of themselves vs a world of majority dependents and a few rich “philanthropists” milking poor people like cattle by offering “services” paid with debt funded by either inflation or regressive taxes

Return the money to the people who paid it.

Stop annually raising our property taxes and other local government fees.

Inflation has hit the supermarket due in part to increased minimum wages.

A $5.00 monthly increase requires households to have an additional $12,000-$14,000 in savings.