A new report has come out showing that the five metro areas hardest hit by the new federal tax overhaul are in California. Here’s how things shake out for San Jose.

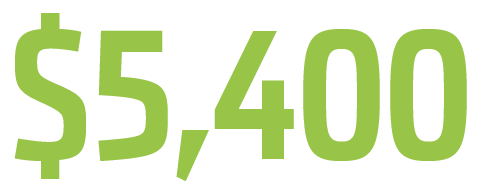

The average San Jose homeowner stands to lose about $5,400 in deductions this year under the recent GOP-led tax overhaul, per a new report by Apartment List. The projected loss over the course of a 30-year mortgage? About $114,000.

The average San Jose homeowner stands to lose about $5,400 in deductions this year under the recent GOP-led tax overhaul, per a new report by Apartment List. The projected loss over the course of a 30-year mortgage? About $114,000.

The new federal legislation hits hardest in expensive coastal markets like the Bay Area, where homeowners in the nine-county region could lose upward of $100,000 in housing-related tax benefits over three decades.

The new federal legislation hits hardest in expensive coastal markets like the Bay Area, where homeowners in the nine-county region could lose upward of $100,000 in housing-related tax benefits over three decades.

The number of predominantly left-leaning states, including California, in which the median homeowner will get at least $100 less in housing tax deductions under the Tax Cuts and Jobs Act of 2017. The Apartment List study says the impact of the tax law is closely linked to the 2016 election and that it’s no coincidence that none of those states voted for President Donald Trump.

The number of predominantly left-leaning states, including California, in which the median homeowner will get at least $100 less in housing tax deductions under the Tax Cuts and Jobs Act of 2017. The Apartment List study says the impact of the tax law is closely linked to the 2016 election and that it’s no coincidence that none of those states voted for President Donald Trump.

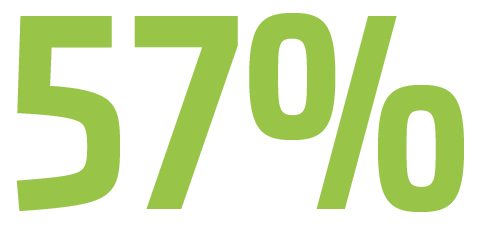

The overall percentage of Santa Clara County residents who own a home, according to the U.S. Census Bureau. That’s nearly 7 percentage points below the national average, thanks to the region’s historic affordability crisis. For white residents, it’s 66 percent, 33 percent for African Americans and 39 percent for Latinos. In past decades, federal subsidies and incentives encouraged homeownership, but the new tax law changes course and may drag down ownership rates, which are already hovering around a 50-year low.

The overall percentage of Santa Clara County residents who own a home, according to the U.S. Census Bureau. That’s nearly 7 percentage points below the national average, thanks to the region’s historic affordability crisis. For white residents, it’s 66 percent, 33 percent for African Americans and 39 percent for Latinos. In past decades, federal subsidies and incentives encouraged homeownership, but the new tax law changes course and may drag down ownership rates, which are already hovering around a 50-year low.

Source: Apartment List and U.S. Census Bureau

so…what ARE those five hardest hit areas in California?

They’re linked in the article: https://www.apartmentlist.com/rentonomics/trump-tax-bill-impact-on-homeowners/

So what credentials does Apartment List possess that makes them a credible scource? Just wondering?

Funny, the usual TrumpTrolls who are always first to post are not commenting on this article. Buyer’s remorse? Let’s hope so. We need this traitor and his thugs out of the White House.

I completely agree with you, these are just ridiculous actions, and this article does not deserve attention. Now in many regions, the taxes are recalculated, and the average homeowner may lose a lot of money in deductions this year in accordance with the recent tax revision in the GOP, according to a new report on the apartment list. But I agree, I would also like to personally talk to this traitor and his thugs from the White House. Recently, the country is becoming more complicated, education is becoming more expensive, taxes are increasing, this should stop!

It’s about time that housing subsidies end for middle class Americans. The mortgage interest deduction should be scrapped entirely.

> It’s about time that housing subsidies end for middle class Americans. The mortgage interest deduction should be scrapped entirely.

Anthony:

I’m probably dangerously idealistic about economics, but my idealism agrees with you.

I think that subsidies are almost always a bad idea and just end up screwing a group of people who don’t know they’re being screwed and giving a benefit some group who absolutely knows which politician heroically “fought for” the benefit.

Although it would be painful for many people, possible including me, I think that ending the mortgage deduction would, at the end of the day, be a good thing for the economy and for prosperity.

Mortgage interest deductions ( and probably all interest deductions) biases our economy toward borrowing and debt. As a result, we are a debt based economy, and such an economy disproportionately empowers lenders and bankers over producers.

> The average San Jose homeowner stands to lose about $5,400 in deductions this year under the recent GOP-led tax overhaul, per a new report by Apartment List. The projected loss over the course of a 30-year mortgage? About $114,000

LJW:

You’re not related to SJW, are you?

First of all, I don’t believe your stupid numbers.

But, just to pump your self esteem, let’s suppose your numbers are right:

“The projected loss over the course of a 30-year mortgage? About $114,000”.

If the Trump tax plan gooses the disastrous Obama economy from a pathetic 1.5 percent annual growth to a merely decent 3.0 percent annual growth rate, the increase in value of an $800,000 home over 30 years would be GIGANTIC!

$114,000 lost deduction over 30 years? Rounding error.

Your career as a business analyst is off to a bad start.

I agree with outside the bubble. This article is another ploy to discredit President Trump. If you really want to understand the new tax law consult your tax man. Every accountant I’ve talked to says the changes are positive for most people in California

From the article:

The number of predominantly left-leaning states, including California, in which the median homeowner will get at least $100 less in housing tax deductions…

What did these people expect? Their insane Trump-hatred is off the charts in California. From the moment he announced his candidacy, everyone near a microphone or a keyboard in the “news” business has constantly badmouthed him 24/7, and they haven’t let up since. With them it’s ‘All Hatred, All The Time’. A show of hands: When has anyone read a complimentary article, approving of what this President has done? Take your time…

If someone had a bullhorn and stood outside the homes of these “Silicon Valley Newsroom” scribblers every day, repeating to anyone who would listen the most scurrilous lies about them—and then the scribblers got into power over the megaphone folks—would anyone have sympathy for the liars?

That’s essentially what happened; the Trump haters constantly poked the bear, and now they’re blubbering like spoiled juveniles because the bear woke up. But what they did affects everyone…

So the blame should be laid right where it belongs: at the feet of Big Media and the Democrat Party, which is absolutely destroying this once golden state by shoveling our tax money into the pockets of the ‘transgendered’, and the 1% of bicycle commuters, and every other tiny special interest group that gets the tax money that used to go to maintain our infrastructure and our basic services—and don’t forget the retired bureaucrats, who have rigged the pension system to the point that the state is facing bankruptcy. But we don’t hear much about that, do we?

Democrats totally control this state, therefore they should properly get the blame for the monumental failures they’ve caused. But as usual, the dishonest media constantly perverts what they’ve done into a finger-pointing charade, intended to blame the victims for the wanton destruction that the Dems and their Big Media pals are deliberately causing by ignoring the basics.

What’s really amazing is that this President hasn’t done more to stick it to this state. Homeownrers already enjoy huge tax breaks, and the majority of them won’t be hurt since their mortgages are under $750K. And really, how badly will $100 less in housing tax deductions every year affect the people wealthy enough to own a home?

But that’s how this President rolls; he turns the other cheek. He didn’t do what he should have done from the get-go: replace all the self-serving swamp critters who are ensconced in their do-nothing bureaucratic jobs.

This President is finding out that there isn’t an iota of appreciation in any of them. They know they’re living off the earnings of honest taxpayers, and human nature is such that their guilt turns into animosity toward the people whose earnings are being confiscated to keep them fat ‘n’ happy in their bureaucrat jobs.

If Trump ever goes down, the central reason will be that he didn’t do what he should have done: fire all those bureaucrats en masse on Day One, and replace them with honest workers who would actually do the jobs they’re paid to do, instead of constantly playing politics.

The one-sided spin in this propaganda piece is enough to make readers dizzy: The overall percentage of Santa Clara County residents who own a home, according to the U.S. Census Bureau (is 57%). That’s nearly 7 percentage points below the national average, thanks to the region’s historic affordability crisis.

But there’s not a word about the booming economy under this President and from this legislation, or about the ‘affordability crisis’ that was jacked up into the stratosphere by literally thousands of Facebook millionaires that were created when the company went pubic—and just about every one of them promptly decided they had to buy a house.

And that’s just one company. There are also thousands of Apple millionaires, and Google millionaires, and plenty of other companies went public—and those folks all want to buy a house, too. What does that do to a mostly static housing supply, where prices are set at the margin?

The authors of this article either need a refresher course in Econ 1-A, or they’ve been writing half-truths. In that case, they needed different parents, since the ones that raised them apparently neglected to teach them that telling half-truths is the same as telling whole lies—and deliberately bearing false witness is a big no-no…

Well said again Smoky,

LJW, bitching about a Federal tax cut, Trump isn’t screwing you, greedy California politicians are by over taxing you. You wanted to tax the rich and redistribute the wealth well there it is brother, and the parasites in Sacrament want to stick it to you some more, because they think we all got to big a break.

Compared to the rest of the country California, NY, and all those blue states have been sucking up mortgage subsidies and have lost revenue for the rest of the country that lives within its means.

So pay up rich boys Trump will redistribute the wealth, maybe build a wall.