San Jose approved two tax hikes last year to fund core city services, such as repaving dilapidated roads and building up a depleted police force. But the $52 million-a-year in revenue collected from Measure B’s quarter-cent sales tax and Measure G’s business tax is being eaten up by the city’s soaring pension costs, according to an analysis by Stanford University’s Institute for Economic Policy Research.

The City Council on Tuesday will discuss the Stanford report, which Mayor Sam Liccardo ordered earlier this year to review an internal audit of San Jose’s retirement plans.

Unlike a special tax measure, which needs super-majority approval and restricts revenue to a specific purpose, the two passed by voters in 2016 were general tax initiatives requiring only a simple majority to raise money for the general fund. With budget shortfalls projected over the next several years and pension liabilities continuing to increase, there’s growing concern that the city is failing to deliver what it promised.

Since San Jose voters OK’d measures B and G, the city’s projected pension and retiree healthcare costs rose by $29 million more than anticipated in 2018 and $57 million more by 2021. By paying the difference from the general fund, the city will basically offset the additional tax revenues.

Unlike private 401(k) accounts or defined-benefit plans that depend on investment returns, public-sector employees are guaranteed an annual benefit based on set formulas. Thus, even if the stock market performs poorly and liabilities rise, the pension payments remains the same, forcing cities to scale back other services to cover the cost.

As pension costs more than tripled over a decade in San Jose, the city tried to rein in liabilities by enacting a controversial voter-approved reform measure, which ignited a years-long legal battle between City Hall and its public employee unions. In 2016, the city finally reached a compromise measure, which promised to save taxpayers money even as San Jose reached about $3.8 billion in unfunded liabilities this past fiscal year.

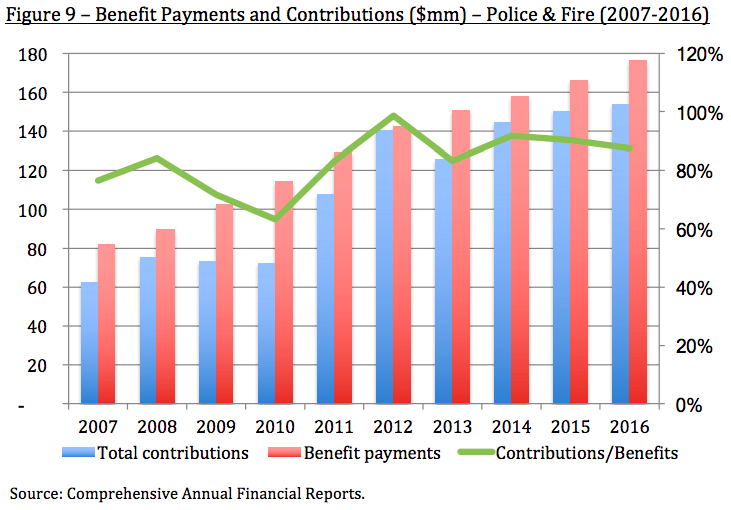

Stanford researchers Joe Nation, Olympia Nguyen Tulloch and Clive Lipshitz spent the past several months evaluating San Jose’s federated and public safety pension plans against those in other major cities in the Bay Area and beyond. They found that San Jose is especially prone to weaker investment performance because of the shortfall of contributions compared to benefit payments. San Jose—like most U.S. public plans, but to a greater extent than peer cities—saw the highest increase in retirees and the largest decrease in the number of new members actively paying into the system.

Though San Jose is hardly unique in this regard, the funded status of the city’s public pensions has deteriorated over the past several years to 72 percent for the police and fire plan and 50 percent for federated employees.

Researchers suggest that portfolio management can be an important tool to address that funding shortfall. However, compared to other cities in the study, San Jose already pays more to manage its pair of pension plans. While most other plans have an investment staff of one or two people, San Jose has 10.

“Over the last 10 years, reforms to the city’s retirement plan structures has populated the boards with members possessing greater professionalism and expertise,” Liccardo wrote in a memo requesting the Stanford analysis earlier this year. “I thank the members of both boards for their service to the city and to our retirees. Still, the poor performance of the plans’ investment over the last three years, by any measure—whether compared to peer public pension plans, to policy benchmarks, or most importantly, to the board’s own actuarial assumptions for rates of return—have substantially added to both plans’ unfunded liabilities and the general fund’s burdens.”

More from the San Jose City Council agenda for November 28, 2017:

- With the wet winter months upon us, the city is ready to declare another “shelter crisis,” which waives certain habitability standards so that community centers and other public buildings can double as homeless shelters. San Jose’s homeless population surpasses 4,300 on a given night, according to the latest count, and includes one of the highest rates of unsheltered people in the nation. With a growing number of homeless people dying on the streets due to exposure and preventable illness, the city will consider paying nonprofit HomeFirst $506,000 to run seasonal shelters throughout the city.

- More than a decade of budget cutbacks, wear and tear and drought have taken a toll on San Jose’s public parks, pushing up the deferred maintenance backlog to $259 million. As the city goes about updating its Greenprint, the roadmap for the future of San Jose’s public spaces, it will explore the idea of creating new financing mechanisms to cover the cost of expanding the park system to accommodate 400,000 more residents over the next 25 years. The next Greenprint iteration will also describe what parks, public space and recreation will look like in a more urbanized San Jose. After the Greenprint is finalized in the coming year, the city will study how parkland fees should be based, collected and disbursed.

WHAT: City Council meets

WHEN: 1:30pm Tuesday

WHERE: City Hall, 200 E. Santa Clara St., San Jose

INFO: City Clerk, 408.535.1260

Our pension and revenue situation remind me of this 80’s PSA for some reason.

https://www.youtube.com/watch?v=XGAVTwhsyOs

> Stanford Study: Rising Cost of Public Employee Pensions Eat Up San Jose’s New Tax Revenue

What?!!

This is shocking!!!

Who knew?

We need to rush through another emergency tax increase to fund public employee pensions.

…and another couple hundred thousand $ for yet another consultant and further study so the politicians and bureaucrats can proclaim themselves blameless

PART 1

Here is your Pension Plan Problem. Police and Fire retire at 90% of base pay. Salaries have been boosted into the stratosphere. You pay a chief $250,000 plus a year, but does he wait until 65 to retire? No he bails at 55 and 20 and you promote another Chief, Assist. Chief, Deputy Chief, Captain, Lieut. and SGT. Next your new Chief bails at 50 and 20 years at 90%. Then you RANK PUMP all the usual suspects again and again. Then they come back with Workers’ Comp Claims they never filed in the past and their Retirement becomes tax free. They pay no taxes. Then the City for 20 years included every perk in calculating their Retirement and now the City Hall Idiots have to claw it back to the tune of Millions.

BS! Only if Police/Five work for 30-years, they get a 90% pension. They would get half that at 15-years and no pension for under 5 years. Regarding the chief making $250k, if the job was so easy, why didn’t you get offered that job? If there is fraud from Worker’s Comp, why didn’t you “grow a pair” and whistleblow?

Jake get you facts straight disability retirements are NOT tax free.

Toby, actually police and firefighter pensions are often are partially tax free. It depends on the “degree of disability.” For police and firefighters, governments use a generous definition of “disability.” It does NOT have to be work related. Often old sports injuries are the basis for the disability designation.

If declared 100% disabled, then half the pension is tax-free from both federal AND state income taxes. Because of marginal tax rates, if 50% of one’s pension is tax-free, that means that one’s total income tax bill will be 70%-80% lower than without the disability designation.

Are partially free is exactly right. But JS states “they pay no taxes which is BS. But thanks for clearing it up.

Part Two

When I retired I got 50% for a 44 3/4 % disability to my spine and leg after all perks were deducted from my $1800.00 a month salary I got $850.00 plus medical and dental. I took care of a wife and two kids and couldn’t find valuable work with a 44 3/4 % disability. No one will touch you. Sam Liccardo made more money in a few months then I did in 20 years in one phony City Condemnation suit that the City bungled deliberately.

> Sam Liccardo made more money in a few months then I did in 20 years in one phony City Condemnation suit that the City bungled deliberately.

What was this about?

Dish!

This is the only eminent domain suit that I remember Liccardo being involved in. Liccardo didn’t make dime, this issue started when Cindy was council member. Once again, I call BS!

http://www.mercurynews.com/2009/10/23/san-jose-to-pay-2-million-to-acquire-parcel-and-settle-lawsuit/

Key phrase? “Valuable work.” Few employers would pay as much as government for someone with your skill set. You got used to being paid too much for blue collar work, and now won’t settle for free market wages. We CA taxpayers pay FAR more for police and firefighters than is paid in the other 49 states.

Maybe you should have gotten a better job, or learned how to code 12 years ago, wah wah wah….give it up. Your future is your own, no one owes you anything for a lack of planning.

But because firefighters and police Officers made a conscious decision to work in a dangerous and stressful position for the end of service benefits, you feel the need to take it away from them. You are truly a hack. What happened to the “Pension Holidays” the city of Slime Jose took when times were good, by not contributing to the pension fund? Whos fault is that?

Valuable work? Computer programming, Safety professional, coding, management, etc….so you are saying that those professions are useless? Get a life, stop complaining about other peoples successes, and grow a pair.

> But because firefighters and police Officers made a conscious decision to work in a dangerous and stressful position for the end of service benefits, you feel the need to take it away from them.

I’d say it’s a mixed bag. Sure, cops/FD the guys that actually put time in the field deserve the extra pay, and they deserve it after their bodies are worn down and they’re flying a desk job. I have no issues rewarding those guys. I hope they buy a nice cabin in Alaska next to a lake so they can enjoy some nature and fishing when they get older.

What bothers me, and Richard I think is there are many many other jobs in the city where people are getting paid grossly compared to fair market rates for a similar job in the private sector. It’s not *just* the pay rate, it’s the benefits and job security as well. It’s not exactly an at-will gig, and a public employee has so many recourses for termination they practically have lawyers lined up to keep these low performance employees in their positions (in the form of public employee unions)

Ya, I respect those dudes that go out. I respect them after they’ve worn out. I don’t have much respect for the ones that screw up consistently OTJ, and sometimes.. Just sometimes they get fired. Need to get that up to 100% if you want to stop hearing complaints like Richards.

And what industry is 100% compliant? The stringent hiring hoops they go through, the academy, the 1 year of probation, and the constant scrutiny from the public is enough. I am willing to bet that the instance of impropriety from Firefighters and Police Officers is exponentially less than that of any other profession, including the medical profession. You will always hear in the headlines “San Jose Fire Captain”…preceding the horrible news that he spanked his child for bringing home a bad grade. All you remember is that “San Jose Fire Captains are Child Abusers”. That is EXACTLY how Chuck Reed, et. al. got all of the measure B nonsense though the sniff test with the voters.

The Fire and Police Departments took the entire brunt of V and W (remember that garbage?) and measure B. If the public really knew how much of our salaries ended up back in the City Retirement system (21.5% per paycheck), and if the public would invest as much as we have for 30 years, they could have a wonderful retirement too.

And by the way, they DO get fired. When the Officers do their job and document bad behavior….we are at the mercy of the City for the rest of the process.

Part Three

Now your saying the pension plan under CORTEX is not paying profits, guess why it takes ten people to administer the fund with no profit? They are all padding their investment pockets in my opinion. 3 Billion plus in this hot market and they have to bump my health care 600% or force me into Kaiser, the death house. People of San Jose, those of you who are legal and pay taxes. bend over a little farther!!!!!!!!!!!!!!!!!

Whining because you have Kaiser? 80% of city employees voluntarily sign-up for Kaiser!

The only truth to your statement is that retirement board members are being flown to “investment conferences”. Then, they are wined and dined and talked into bad investments (attending these conferences should be banned). The city should invest in “indexed funds” instead so they can reduce their staff.

a hundred plus years ago – during the bad days of big timber, oil, steel and coal – when the company literally owned the town and everything in it – unions were a good balancing force Todays public employee’s should be ashamed for hiding under the union racket which pimps them to politicians, i.e, money = votes (in case no one has figured that out)> why do public employees need unionization? They are not working for the big bad timber, steel, coal private companies – – they are working for their community, their neighbors – themselves.

fix a nationally based scale adjusted for Cost of Living, etc etc – and pay and treat employees fairly. it is the corrupt union/politician vampires that suck the life blood out of our cities and state. This started in 1979 when then Gov J. Brown signed the Dill Act – allowing for public employee collective bargaining – -before that we were known as the Golden State – -now we are a mess and we are ruined.

I call BS! Unionism for government employees dates back to the Spoils System/creation of the Civil Service. If government employees do not have the right to unionize and have basic job protections, elected officials will hire their “friends” for all government jobs. Do you want 100% turnover of city employees after an election? Do want a police officer who was trained as a police officer or someone given a job as a police officer because they supported the person who won an election?

Hey “Let a Life?” – I will wager a $100 that you are a registered democrat. How do I know this? because CA and this city are controlled by a single political party – the communists – – – eh, I mean the democrats. We’ve been a one party state and city for decades – just like our other public institutions. Just like the old USSR – and we say how that went – right?

right now I would wager that 95% of the people working for the city are democrats – “the people’s party”.

For you to say that an elected official would put his friends into government jobs must be a lot to choke down. And this explains why the Capitol of Silicon Valley is broke – has been and will continue to be – -because more and more of our tax $ goes to pay the very well off retired union public employees – who take home far more than the poor honest working schmucks that support them and their bloated bureaucracy – filled ironically with their friends and fellow party members.

Just like Chicago and other big city union run towns – San Jose will have it’s day of reckoning.

I only wish what you said was true. The former Mayor Reed and top appointee Figone did everything possible to push out every city worker so they could hire new employees under Tier-2 pension. They called the police “drinking from the public trough” and flat out said “employees will be dropping like flies when the Measure B hits start to kick in”. The only problem, way too many City employees left! Look what happened at the Police Dept, City Attorney’s Office, Planning Dept and the Water Pollution Control Plant was dangerously understaffed.

Now read the article above. What surprise does Liccardo have for City employees? Why did he order this study? I see it happening again.

Fact, the average non-management, non-safety City of San Jose employee earns $65,000 per year and his/her average pension is $35,000. For clarification, this does not include management, police and fire.

OVER 70% OF PUBLIC EMPLOYEES ARE MILLIONAIRES… ON PAPER!

The average pension is not $35,000 a year, that is a union talking point. According to the California Policy Center, the average full career (30 years work) pension for a retired public employee in California was $68,673 in 2015, not including benefits. This is in comparison to the average pay (not including benefits) for an active full-time worker in the private sector in California, which in 2015 was $54,326, and to the maximum Social Security Benefit for a high wage earner retiring at age 66, which in 2015 was $32,244. Put another way, the average public employee retiree with 30 years of service collects a pension (not including benefits) that is 26% greater than the average pay for a non-retired full time private sector worker, and more than twice the maximum Social Security.

However let’s use your number for a little bit of fun with math. God willing the average Public Employee will live at least another 30 years after they retire at 55. But for argument’s sake I will run the numbers with 10 and 20 years of life after retirement as well to show you what it would cost for a private sector person to purchase an annuity that would payout the equivalent of your average public pension:

30 years x $35,000 = $1,050,000

– Annuity cost = $605,000 w/ 4% annual return

20 years x $35,000 = $700,000

– Annuity cost = $475,000 w/ 4% annual return

10 years x $35,000 = $350,000

– Annuity cost = $285,000 w/ 4% annual return

Now with the real numbers:

30 years x $68,000 = $2,040,000

– Annuity cost = $1,175,000 w/ 4% annual return

20 years x $68,000 = $1,360,000

– Annuity cost = $925,000 w/ 4% annual return

10 years x $68,000 = $680,000

– Annuity cost = $550,000 w/ 4% annual return

Now these numbers don’t even include the cost of retiree health benefits, which most experts believe is at least if not more then the pensions.

Do you really believe the taxpayers intended to make most public employees multi millionaires? I don’t!

All of the tax money you will be taking in from marijuana sales should make up a lot of loss. Colorado took in a billion dollars in pot tax money, last year. Stop making excuses.

Who could have predicted that when you screwed employees over they would leave in droves, including retiring earlier than they had planned, or that when they left and you couldn’t hire any new employees because you had the lowest pay and benefits in the area, you would have less employees paying into your pension fund than you have collecting from it? Could anyone have possibly predicted that if the employer took “pension holidays” and didn’t pay their share into the pension fund for years, the fund might have financial problems down the road? If only the employees, who are at fault for all the city’s financial woes, had warned the city “leaders”.

Move everyone to Social Security

Here’s my solution:

https://drive.google.com/file/d/0B90sU3A85q46OE9BZHJFSWEzbGM/view?usp=drivesdk

Thoughts?

Fake news! Only a small percentage retire with 30-years, but don’t take my word for it. Submit a Public Records Request to SJ Retirement Services to see for yourself. Also, request the average pension payments for non-management, non-safety retirees.

Here is the truth. If you work for the City and leave one-day before completing 5-years. You only get your retirement contributions back and nothing from the City.

If you work for the City for 10-years, you are still barely coming out ahead due to Social Security’s Windfall Elimination Provision. For anyone vested in Social Security (like me-I completed my 40 quarters) prior to public employment. Since the City does not participate in Social Security, they hold it against you and will reduce my Social Security accordingly:

https://www.ssa.gov/pubs/EN-05-10045.pdf

Therefore, you need to work for the City for more than 10-years just to come out ahead when factoring in the hit from Social Security.

You are correct, if you work a 30-year career for the public agency you will receive a substantial pension. But life doesn’t work out that way. You would need to start your employment right after college and decide to stay for 30-years so you could hit the 30-year mark.

You may be right about “only a small percentage retire with 30 years”, but according the California Policy Center the average CalPERS retiree worked for 19.93 years. So again, how many people do you know personally that could even afford the annuity required for someone with “only” 20 years service? Oh yeah, and what about the healthcare benefits for the rest of their lives?

Regarding SS, I will swap you my expected benefits from SS any day for your public pension and healthcare benefits!

T B- You have an error in your math. What about the retirement contributions made by the employee over the course of the career? In SJ, we pay 15% of our pay and the police/fire pay 21% towards retirement benefits. You make is sound like no contributions are made by the employee. This will change your numbers dramatically.

According to your own city’s website, there are 3 tiers of employees with varying amounts of employee contributions:

Police & Fire Employees

1) Legacy (POLICE PRIOR JULY 2, 2006 and FIRE PRIOR JULY 1, 2008)

Employee contribution = 11.26% for Pension

Employee contribution = 0% for Healthcare

2) Tier 1 (As of 6/18/2017)

Fire Employee contribution = 11.38% for Pension

Fire Employee contribution = 9.74% for Healthcare

Police Employee contribution = 11.38% for Pension

Police Employee contribution = 9.74% for Healthcare

3) Tier 2 (As of 7/30/2017)

Fire Employee contribution = 15.17% for Pension

Fire Employee contribution = 0% for Healthcare

Police Employee contribution = 16.26% for Pension

Police Employee contribution = 0% for Healthcare

________________________________________________________

So you are correct if you are a Tier 1 employee, but how many new hires have there been since June 18th of this year? Obviously the great majority of fire & police are in the Legacy category, and quite frankly everyone knows this is where the real “math” problem resides. Therefore the cost of the annuities I laid out above would be discounted by 11.26% – BIG DEAL!!! And what about the free healthcare for the rest of their lives.

Honestly, tell me how many private sector friends or family you know that could actually afford even the smallest of annuities required to just match the pension of a safety public employee?

Just stop. You are jealous because YOU DONT GET THE BENEFITS! Call it like it is.

Our tax dollars pay for this in the end. It is time to stop growing wasteful government.

Of course I’m jealous, who wouldn’t be? I and all taxpayers are responsible for funding these exorbitant benefits for individuals that pursued a less stressful and far easier existence in the public sector, while the rest of us struggle to achieve a retirement that is not guaranteed such as yours. Please don’t say social security.

But more importantly to me, is the intergenerational theft that is occurring and fully supported by the public union sectors. Not sure if you have children like I do, but just think for a moment what we are doing to them and their children, and probably even their children!

“Of course I’m jealous, who wouldn’t be”?

There you go John…I was talking to him, not you.

Don’t you have any concern for future generations? Do you have children? We are putting an unsustainable burden upon them and something must be done.

So what, you think I dont earn what you pay me? As I have said before, if you want to privatize the Fire Department, what you pay will not go down, it will go up. And as for any unforseen medical issues you have, just pass your mastercard or visa through the slot, and if you have to ask how much it costs…you cant afford it.

Im sure you whine about your car insurance, homeowners insurance, dental insurance and the cost of your starbucks in the morning…right? The difference is, you have such wonderful courage to kick the Firefighters and Police Officers because you KNOW they have no voice to fight back. Exactly why we need a Union….to protect us from you.

Fine Bohica

That’s a copout Bohica.

Not every human is animated only by negative emotions like jealousy, envy, and greed. It’s intellectually dishonest to dismiss an argument you don’t like by attributing impure motives to the commenter.

For the groups that do not pay in healthcare, guess why? They don’t get retiree healthcare.

You are missing the point regarding the employee contribution, the contribution is made throughout the entire career, not just a one-time payment like you are referring to. Also, you have to factor in inflation.

In fact, twenty years ago you would have been much better off not taking a government job (and been required to pay towards a pension & heathcare). Instead, had you bought house in Silicon Valley, you would come out ahead.

Healthcare for life? Nope, everyone is put into Medicare at 65. Yes, City employees also contribute to Medicare so the City can drop you at 65.

Free healthcare? No, we’ve contributed towards retiree healthcare our entire careers. At retirement, the only free heathcare option is the Kaiser high-deductible plan ($3,000 annual deductible). If you want anything better, the employee ponies up the difference.

Someone needs to look into why the Council is getting $102,000 salary right now. In June they voted to give themselves a 3% pay increase. At that time their salary was $92,000. A $10,000 increase is far more than 3%.

http://www.sanjoseca.gov/DocumentCenter/View/66016

http://sanjoseca.gov/DocumentCenter/View/1206

Hopefully Josh will request emails regarding this issue. They are covering it up.

Well, lifetime politicians on a public salary are on a different level and should not be grouped in with employees working for a living. Politicians who move from each and every gov’t agency when termed out are the bottom of the barrel. They don’t even deserve the title of public servants and hardly deserve a six figure salary.

The main reason to ignore this story is the headline “Stanford Study”. Stanford has never supported public service and has been adamant about their disgust for employee organization. After working with Stanford over the years, they proudly proclaim that all employees in public service should be Stanford graduates (probably because most graduates are unemployable). Name three Stanford graduates that have been employed with one company or entity for 30 years! Y’all can crap on public employees but when it comes to getting service who do you call? So much for the JFK proclamation at his inauguration speech. Oh well….

With the overall economy expanding to record levels, how do the investment advisors justify their performance and fees?

Also, is not the $20.00 fee on our vehicle registration supposed to go to local road maintenance? Where does that money go? Thank you.

Pensions are not the cause of budget shortfalls. Please remember politicians are the cause for budget woes. Republicans and Democrats spend money on pet projects without first making sure our infrastructure, basic services and schools are funded. San Jose City promotes charter schools knowing some schools are closing because of shrinking student population. We don’t need more charter schools we need less students in classrooms and working bathrooms and school yards that are clean and maintained.

The City of San Jose laid off many employees and caused the pension problem. Please also note City employees do not receive social security because they do not pay into the system. Every month retired employees die but the City does not mention how much money they are saving when this happens. The City also continues to grow without thought of how they can provide services to its residents. They lose money by offering tax breaks and exemptions to businesses who do not need it. Trump and the Republicans are spending money knowing we have a large deficit so lets not talk about the “fake news” story on pensions and how much they cost taxpayers.

In reading the comments from our government commenters the government’s message is clear:

Pay your taxes and shut up.

San Jose pays their public employees less than anyone in the bay area. Their pension is the same as every other city now (2% a year, 5 years to vest, retirement age of 62, no retiree medical). Nearly every department struggles to keep staff. There is no reason to work for San Jose anymore. I just hope the people complaining about employee pensions and salaries are not the same people whining about not receiving enough service, waiting too long for inspections, complaining their parks are dirty, there is graffiti, neighbors aren’t maintaining their properties, people are parking wherever they want, police aren’t showing up to most calls, abandoned vehicles all over town, people living in trailers on the street, blight, etc.

> There is no reason to work for San Jose anymore.

Mr. Scared.

There is no reason for YOU to work for San Jose anymore.

And if you don’t have a reason for working for San Jose, it’s hard to see why you would have a reason for COMPLAINING about working for San Jose.

Maybe you could complain about something else: high taxes; illegal immigration; election fraud; identity politics; fake news; etc. etc.

> Stanford Study: Rising Cost of Public Employee Pensions Eat Up San Jose’s New Tax Revenue

California needs to quickly pass massive tax cuts for rich people, or else.

Or else what?

Or else the 10 percent of taxpayers who pay 90 percent of taxes are going to head for the exits. And Jerry Brown won’t be able to raise taxes enough on those remaining to pay for all the sugar plums that Democrats want.

Taxes can only be raised to 100 percent. After that, there’s nothing more to take.