San Jose voters appear open to paying higher taxes to restore services and doubling the tax on pot clubs, according to a new survey commissioned by the city.

Just before summer recess, the City Council directed staff to conduct polls on four potential tax measures—a general purpose sales tax, a sales tax dedicated to road repairs, a sales tax dedicated to public safety and a marijuana business tax increase.

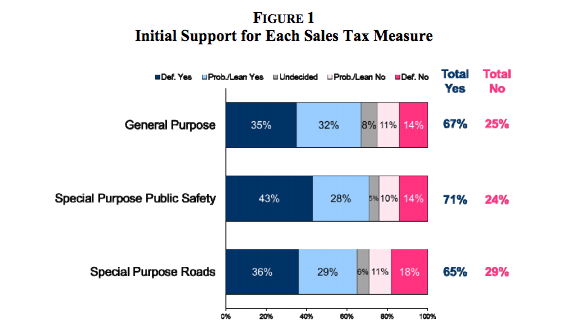

Of the 1,515 people polled, 67 percent favored the general sales tax, 71 percent the public safety tax and 65 percent for the road tax. The existing sales tax is 8.75 percent.

But only the general tax garnered enough support, more than two-thirds, to significantly surpass its voter threshold. A general purpose tax needs only a simple majority to pass, compared to a two-thirds majority for a special purpose measure.

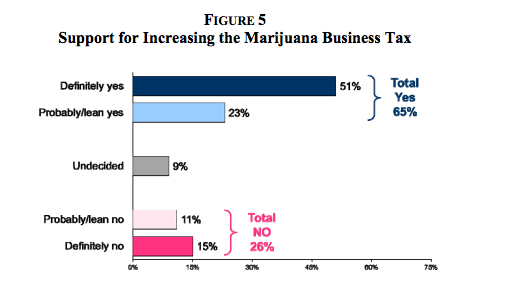

Sixty-five percent of respondents said they would support a ballot measure to bump the marijuana business tax from 10 precent to 20 percent. Twenty-six percent said they would vote "no," and 9 percent were undecided.

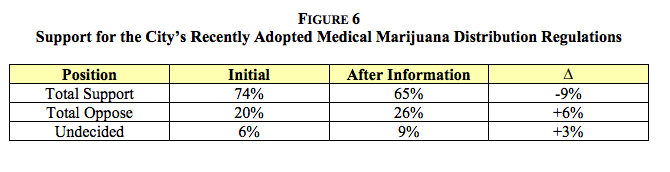

Mayor Chuck Reed also directed pollsters to gauge public reaction to the city's recently enacted medical marijuana ordinance. Overall, it was pretty favorable, but less so after people were read more information about it.

Some 74 percent of respondents said they support the city's new rules on how pot clubs should operate. Only 65 percent expressed support after hearing arguments for and against it. Of the 20 percent opposed to the new rules, most felt that the city "went too far."

Polling firm Fairbank, Maslin, Maullin, Metz & Associates recommended placing the quarter-cent general sales tax on the November ballot since it stands the highest chance of passing. A quarter-cent tax increase would generate $10 million a year.

The council will consider the item when it meets Aug. 5.

Wait.. So Measure B didn’t restore city services? Where’s all the “money” going then?

Steve Rodgers, if a household is spending more than it brings in and the children’s allowances are reduced to balance the budget, would it make sense for the husband to ask the wife what they’re going to spend their savings from the children’s allowance on? Measure B’s benefits are in longterm fiscal solvency and ceasing to contribute to a mountain of debt which we’ve only begun to surmount.

Your analogy would be more persuasive if Reed hadn’t completely fabricated data.

And you would be more persuasive if you didn’t use such a juvenile pen name. But let’s get this straight- my analogy is true whether or not Reed exaggerated projections for future debt (I don’t dispute that he did). To use a different analogy, if someone tells me that one hundred tanks are rolling down the street towards my house and I realize that it’s only half that amount, that doesn’t mean that there’s no problem. If you tell me that there’s no reason to be concerned about the fifty tanks because someone completely different claimed that there was actually one hundred tanks, then you are foolish.

for a minute there i thought you were REED……..

Carthagus nobody is listening to your broken rhetoric anymore blah blah blah blah… Meanwhile, once again, there was a violent double shooting in SJ this Saturday night! It must all be UF Union Fiction…. I wonder how many cops the union will persuade to quit this week? I hope Chuck Reed isn’t paying you to be such a suck up clown

I have a simple response to your overly simple analogy (not your leading question) – No. Just no. Stop it.

Here’s something closer to reality. When Sam is back from vacation you can share this with him at your next staffer meeting.

A family which has a very high income (compared to cities of equal size and population) has been steadily earning more and more each year. Husband and Wife decide things are good so they want to buy new land and build a new house to leave their old modest one (DTSJ City Hall). Along with this they decide, let’s take out some loans to upgrade the garage (SJ Mineta), and while we’re at it, we’ll remodel the yard and even help our neighborhoods with special projects with special money coupled with more loans (Redevelopment). Meanwhile, we’ll keep buying groceries and going out to dinner with little care about how much they spend.

All of the sudden.. The interest rates from all of the remodeling and special neighborhood projects skyrockets. That special fund and those loans, well.. The tax man says they can’t set money aside like that anymore, and on top of that blew it by taking out huge loans they knew they couldn’t pay back anytime reasonably soon. Yet, they still go out to dinner with friends (Lew Wolff and the A’s).

So what are they to do? Top Ramen and Tuna. Kick the older kids out of the house, start riding your bike to work, and stop buying groceries.. What? Its gotten worse? Feed the kids only enough to keep them from starving, tell them its all their fault so the neighbors won’t think you’re irresponsible and just worry about paying the bills you racked up when you thought things were good and frivolously spent and accumulated debt. Tell the kids their college fund they’ve been working for, well.. Too bad, we’re slashing it and you’re gonna pay more cause you’ve been riding the gravy train all along.

Well.. Almost all of your kids have moved out, your lawn is full of potholes, your neighborhood is in shambles, the kids who remain are emaciated.. No one wants to be your kid.. Your neighbors laugh at you, and the debt collectors have backed off a little. Your investments are recovering, but just to save face.. Keep blaming the kids. It was their fault to begin with. Never mind the lawn.. Forget the neighbors.. Its none of their business anyway.

– Of course.. This skips plenty of the issue,

But you get the point.

Nowhere in your longwinded parable did you analogize the role of pension obligations in San Jose’s fiscal crisis. Do you honestly think they had nothing to do with it and were sustainable? Retirement costs were consuming twenty percent of the city’s general fund when Measure B was put before the voters.

20% compared to what? What do all the other cities that are not going down the toilet pay? Do you even know or have your staffers been withholding that information from you?

And what was so wrong with that 20% number anyway? I recall having far more police and far less crime back when it was at 20%. Or is the current crimewave just a feature of Measure B, not a bug.

Measure B was nothing but a cover up for all over up for all the crap Reed signed off as council / mayor. They put big number to settle contracts then moved money around in good times and when thing went south it was time to put blame on unions. They (council ) lost on bad financial advise and needed someone to blame.

You’re correct Carthy – I didn’t.. Because it “was a problem” due to poor return on investments coupled with the city’s CHOICE to take a pension holiday when the returns were paying the city’s obligation. Do I think things were sustainable? No.

Had Gurza (at the direction of Chuck & Deb) and the city’s bargaining unit actually sat down and listened in good faith, this big debacle would not nearly the mess it is today.

Do you agree (or even acknowledge) that we have a public safety crisis in this city? Do you think San Jose can keep offering the worst benefit package in the state to new police officers and expect quality hires who will stay?

I do not have pot holes in my lawn, they are just brown. But my street sucks thanks to city council

You think you got it bad, come see what they did to the corner of Almaden and Cherry. “Traffic Calming” by ripping out a dedicated turn lane. Nobody in my neighborhood even uses that route anymore, we go around it. We go up Meridian or down Brahnam to Pearl. All so the trucks going to Walmart and the Almaden Ranch development could have an easier time getting in and out.

Empty promises and a parking lot where Almaden Expressway used to be.

The City did not get bad legal advice by accident. They knew they were on the wrong side of the law when they ignored the advise of their own City Attorney, and proceeded to shop for legal council who would win there attempt to circumvent provisions for public employees vested rights. Its a moral issue.

Unfortunately too many attorneys like Charlie think that the mission they learned in law school is, there is no wrong or right, just what you can get away with.

Colorado earned $19 Million Dollars in the Month of March. Goes to show you what can be done when you have real leaders with a real plan

The City of SJ may be owed many times that amount in taxes that some local clubs collect but fail to turn over. Raise the tax on pot? OK but if the City can’t or won’t attempt to collect what it is already owed what difference does it make?

We sure have an idiotic voter base, don’t we. Overwhelming support for an increased marijuana tax yet just as much support for driving that cash cow out of town.

In support of your premise on the voters intelligence: They are the same that voted George Jr. to a 2nd term to Council, then to the EUSD board, and finally to Country supervisor. Charlie takes great pride in his electorate’s choice to cut others pensions, as long as it’s not theirs. Note the average salary in San Jose, plenty of nest eggs here. But how many voters have any idea how much of their total tax liability goes to municipal pensions? But I actually don’t blame the voters totally, as gullible as they are to campaign rhetoric and flyers, considering the pathetic record of our primary news sources in presenting balanced and comprehensive information on the issues and the candidates.

Not that pot clubs are going to be effectively banned, might as well raise the tax on them to 100%!

Carthagus,

Your insulting analogy using children in the role of this city’s cops and firefighters reveals you to be a bold and brave hombre. Is that a representative perspective of the Liccardo campaign, that this city is protected by children? And by the way, why don’t you share with us a story of how you boldly and bravely insulted one of those “children” when he (or she) was off-duty?

I notice that, while wildly imprecise with certain bits of information, you are quite careful when citing the pension impact to qualify the impacted budget as the “general fund,” offering a precision that was noticeably absent when pension “reformers” were selling Measure B to the public (and was reliably absent in the pro-reform comments posted on this blog). In fact, were it not for the efforts of honest and informed commenters here the budget distinction would have remained where Reed and Liccardo wanted it, buried in the details.

Something else you’re careful about is the point in time when pension obligations accounted for 20% of the general fund: during the Measure B campaign. Perhaps this is because that figure is nowhere near historically reflective of the pension obligation, but is reflective of the impact of the mortgage crisis that threatened every financial structure in the nation. But for those of us who remember Reed’s drumbeat wail about obligations having tripled, then we can deduce that the pension obligations (for the entire city) were 7% in 2002 — a figure quite a bit more representative than 20%.

By the way, that public safety pension that you argue was unsustainable, tell me, was it unsustainable during those years when the city’s crippling obligation was zero? Was it unsustainable when, year after year, professional actuaries endorsed it? Was it unsustainable during its half-century of award-winning performance? Let me help you with the answers: no, no, and no.

In fact, whether the pension ever became unsustainable is open to question. Certainly it was broadsided by the mortgage crisis, as were all city obligations and revenue sources, but had the Reed administration resisted the temptation to grab headlines and play power politics, and instead sat down with labor and actuarial experts, solutions may have been there for the finding. Of course, if you have evidence proving otherwise, I’d love to see it.

Oh wow! Big news.

People who don’t pay taxes favor increasing taxes on those who do pay taxes.

oh brother here comes another teabagger……the only people on the planet who pay taxes lol moron

Clever little ANTHONY blogs again from his basement compound, presumably without his mother knowing:

> oh brother here comes another teabagger……the only people on the planet who pay taxes lol moron

Hmmmmm.

> SJI Comments Policy

> •We will not post racist, sexist or sexually explicit comments, obvious commercial promotion, off-topic comments or comments that constitute a slur against a person or group.

I’m reading the fine print here. It says that clever little ANTHONY can’t post a slur against “a person or group”.

But if he posts a slur that offends MORE than one person or group, does that make it OK?

It seems odd that the SJI policy would tolerate complex slurs that offend multiple groups but would prohibit slurs against an individual person or group.

But, I never went to law school and these refined distinctions are beyond me.

And, by the way, does “teabagger” fall into the category of a “sexually explicit” comment,

( http://en.wikipedia.org/wiki/Tea_bag_(sexual_act) )

or is it now acceptable practice for people to sit around at the SJI Metro offices, sip free range lattes, show off their scrotums and talk about what they did with them over the weekend?

And, by the way again, doesn’t this exclude SJI Metro’s female employees?

Dude, stop being a 5 year old.

> Dude, stop being a 5 year old.

No one over the mental age of eleven ever begins a thoughtful contribution to a serous intellectual discussion with “dude”.

How’s the surf, dude?

(In case you’re unsure, I really don’t give a crap how the surf is.)

all of a sudden the teabaggers want to play nice lol……thoughtful contribution hahaha is that supposed to be some kind of joke mr i’m my own biggest fan – mr irrelevent – mr but my taxes are relevant……bubblebrain

Who are these “…People who don’t pay taxes favor increasing taxes on those who do pay taxes…?”

First off this poll was on a SALES Tax increase. Who doesn’t pay sales tax on retail purchases. Heck even the pot heads pay the “sin tax” the City mandated to give the collectives some level of “legitimacy.” A tax that the collectives advocated for and were very willing to collect on the City’s behalf. I wonder if a true audit were done would the amount the City collects approximate the amount that are owed…

Second, Are you saying that the City used a polling company that would poll persons who did not reside or make frequent purchases in San Jose? Are you trying to say that non-residents and non-retail consumers account for the high approval numbers on a three three sales tax increase scenarios?

If that is what you think then maybe you should start questioning the quality control on City expenditures.

67%/71%/65% Wow, those are “overwhelming” numbers for approval. The City polled these tax increase possibilities for the 2012 General Election. I don’t recall the percentages -maybe they were published somewhere – maybe they weren’t in the City’s stated commitment to “transparency.”

What I am certain is that despite polling that favored a sales tax increase to fund public safety the City Council declined putting forward a ballot measure . Mayor Reed said, “now isn’t the right time.”

If the council opts to put a tax increase on this ballots Mayor Reed needs to be asked “what changed?”

In the very near future – perhaps it is happening right now – raw crime stats for the first 6 months of the year will be released showing significant decreases in crime in SJ. murder/rape/robbery/assaults/ burglary/auto theft….. all down in many instances double-digit percentage decreases. Police staffing is down (way down) and Measure B is in effect for the few new hires SJPD and Fire are “attracting.” the Police and Fire Retirement system “unfunded liability” is much lower than it was being used as the biggest reason for pension reform ( I hear the fund is 80-85% funded – which for ANY pension fund anywhere is remarkable). All this says that costs are down.

Further, the City’s general fund going from red to black sometime in 2015-2017 was predicted long before the manufactured “pension tsunami” narrative began. The budget going from red to black early (last year) can be attributed to one thing: savings the City realized from employees giving back 10% of their salary . The budget was pushed further into the black through savings associated to the budgeted but unfilled positions in the police department.

City Math says that $1million = the cost of 7 police officers (salary/benefits). SJPD is currently authorized to employ 1109 officers but is currently staffed with fewer than 1000 Understaffing by just 100 fewer officers results in budgeted savings of more than $14million dollars (actual savings are much higher because SJPD is understaffed by many more officers).

Based on budgeted savings through understaffing raises another question for the Mayor and Council:

What is the City doing with the money it is saving due to understaffing? Is the CIty banking that money for the inevitable “rainy day” like they did not do when they took the “pension holiday?” or – are they burning through it as fast as they can on ,,,,, on… on…. WHAT?

Carthagus – Where’d you go? The Meyer brought up some extremely pertinent new info..

The primary supporters of pension cutting measures in San Jose are big boys of the Chamber, housing developers, etc. Note there were no grass roots TAXPAYER PAC involved. In fact one the big contributor was the nationwide Realtors PAC. Go figure, keep property taxes down. These folks love the results of this poll. Let the residents pay for everything, so they can continue to get their subsidies and special treatment.

This is right in line with the direction of America’s global corporate community, who are keeping massive amounts of profits offshore to avoid taxes. This includes several of Silicon Valleys darlings, Intel, Apple etc. The most disgusting trend is large corporations resigning their USA citizenship to other Countries.